How the Dodgers Keep Winning the Offseason: Contract Deferrals

At the end of every offseason, baseball fans have to look back and think, They can’t keep getting away with this.

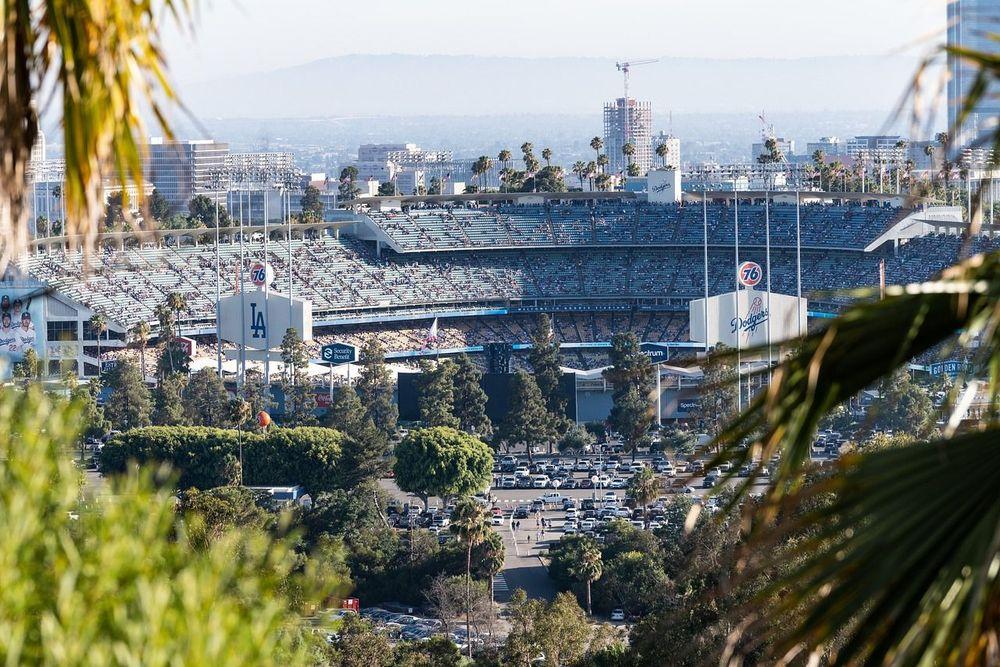

The Los Angeles Dodgers, over the last 10 seasons, have a record of 939-580 while also making the playoffs all ten of those years, including a World Series championship in 2020. The long track record of success can be traced back to their development system and their ability to acquire and retain some of the biggest talents in the league. In the 2024 offseason alone, they spent over a billion dollars for generational talents Shohei Ohtani and Yoshinobu Yamamoto.

Let's take a look at one significant way they’re able to do this, and why it leads to their continual success year after year: contract deferrals.

Money Deferred Until Later = Less Real Money Now

The current Collective Bargaining Agreement (CBA) between the owners and players allows for any amount of money in a contract to be deferred, which means it really comes down to how much an owner is willing to pay down the line and how much money a player is willing to wait for.

Ohtani, for example, signed his record-breaking 10-year, $700-million-dollar contract, but is deferring $68 million of it every year that is to be paid between 2034-2043.

Because of inflation, the present value of that number is much less in today's dollars -- that is, $1 today is worth a little bit less every year. So by 2034, $68M per year will buy Ohtani significantly less than it would today.

With deferrals, the salary number taken into account for tax purposes is the average annual value (AAV) of the deal, so in Ohtani’s contract, that value is estimated by the Players Association at $46 million per year, saving the Dodgers more than $20 million per year, and allowing for nearly $200 million in saved money over the length of the contract.

This approach allows the Dodgers to keep their Competitive Balance Tax (CBT) number artificially low, and enables the Dodgers to acquire talents like Yamamoto by structuring his deal this way. As we can see in the table below, LA is doing this with most of their major stars.

Star Trio Contract Deferrals

| Player | Contract($) | Deferrals |

| Mookie Betts | 12 years x $365 Million, 2021-2032 | $115 Million, 2033-2044 |

| Freddie Freeman | 6 years x $162 Million, 2022-2027 | $57 Million, 2028-2040 |

| Shohei Ohtani | 10 years x $700 Million, 2024-2034 | $680 Million, 68 Million from 2034-2043 |

Projected Remaining Surplus Value for 3 Big Contracts

(salary numbers adjusted for effect of deferrals; columns indicate value remaining on each contract, so for Betts, as of now he's still owed $310M, but adjusted for deferrals, it's $219.3M)

| Player | Field Value ($Ms) | Salary ($Ms) | Surplus Value ($Ms) |

| Betts | 306.3 | 219.3 | 87 |

| Freeman | 129.2 | 98.8 | 30.4 |

| Ohtani | 526 | 460 | 66 |

| Totals | 961.5 | 778.1 | 183.4 |

In effect, the Dodgers are underpaying (relative to market value) these three superstars by a total of $183.M. And that's not counting guys like Max Muncy, Will Smith, and younger players like James Outman, who are also providing surplus value.

This also explains the salary number that BTV takes into account when tracking salary for all these players. As we can see, the impressive part of setting up contracts this way is that Freeman, through his age 34-37 years of his contract, will still be providing surplus value. As we’ve seen many times, long-term contracts in baseball often become albatrosses when a player ages past 30, and especially in the latter stages of his career.

Why The Deferrals Matter

A lot of the credit should go to the players as well. These are some of baseball’s biggest stars – and in the case of Ohtani, the current face of baseball – and to be sure, they’re buying into the idea of deferring millions of dollars to be able to get the opportunity to play alongside top players they might not be able to otherwise.

Of course, fans will say they’re getting paid millions anyway. But a million dollars 10 years from now is not what it’s worth today, so the players ultimately will get paid less in real value. The team is operating in a system of paying players well into the future for the opportunity of winning championships now. Many teams have attempted this strategy (see below), and it’s a fine line, but one the Dodgers seem to have been able to walk perfectly lately.

Let’s illustrate this by comparing team payroll rankings (from the Team Rankings section of our site) to our team surplus value rankings:

BTV Team Payroll Rankings, 2024

| Rank | Team | Projected Payroll ($Ms, USD) |

| 1 | Dodgers | 1384.8 |

| 2 | Padres | 1355.3 |

| 3 | Phillies | 1127.5 |

| 4 | Yankees | 1111.3 |

| 5 | Braves | 1009.4 |

Team Surplus Value Rankings

| Rank | Team | Majors Field Value ($Ms) | Majors Salary ($Ms) | Majors Surplus Value ($Ms) |

| 1 | Braves | 1943.6 | 1009.4 | 934.4 |

| 2 | Mariners | 1608.1 | 865.5 | 742.5 |

| 3 | Reds | 1294.7 | 731.7 | 562.8 |

| 4 | Orioles | 1039 | 522.2 | 516.9 |

| 5 | Diamondbacks | 1077.7 | 567.9 | 510.0 |

| 6 | Dodgers | 1888.9 | 1386.3 | 502.7 |

The fascinating part of the second table is the Dodgers’ salary value compared to the other top teams. The Braves barely top $1,000 (in $Ms) in large part due to locking up much of their core to long-term team friendly deals early in those players' tenures, which is why they rank high on surplus value, at over $934M.

Meanwhile, teams like the Reds, Orioles, and Diamondbacks have a lot of surplus value because they’re just now beginning their upswing after many years of rebuilding, so their core talent base is relatively cheap.

Big spenders like the Phillies and Yankees, by contrast, are 24th and 23rd in the Surplus Value Rankings, respectively (at $146M and $174M), which means they're essentially paying market value for their players.

The Dodgers, however, are No. 1 in team salary commitments. They have committed almost $1.4 billion in salary to top players, yet still have half a billion in surplus value to show for it. In other words, through this mechanism, they’re paying less for top talent than other teams are.

The Dodgers are spending, but they’re doing so effectively and efficiently.

So the next time you wonder why your team isn’t doing the same, figure out how to acquire the next Andrew Friedman as your President of Baseball Operations.

About the Author

Comments

1Thanks Kohl, an interesting article. As a fan of a small market team (Cleveland) I don’t have any real issues of what the Dodgers are doing. It is what it is. The built in advantage of the LA (or NY, or Chicago) market is the issue (and now the cornering of the entire Japan market). These Hall of Fame players know that if they sign with LA they will be playing every year for a World Series, in front of sellout crowds, have access to likely the best off field facilities/staff, and more importantly will probably make up the deferred money through endorsements anyway (internationally, nationally, and locally). It’s a package that very few organizations can match, especially small markets. The Dodgers are smart enough to take advantage of this, but the real question is it good for baseball? I suspect the sport will survive like it always has. Thanks again.